Bitcoin dropped to lows of $8,980 again as price remains trapped in a range

Bitcoin price is likely to break down if indicators remain bearish as seen over the past few weeks.

As has been observed since the supply squeeze in May, the price of the benchmark cryptocurrency has been stuck in a rut. Traders have faced rejections at a crucial top, while potential downturns have faded at just under the $9,000 support zone.

It is this outlook that sees several analysts pointing to a short term breakdown in Bitcoin price.

Bollinger Bands suggests a big move soon

Bitcoin’s price rejections around $10,000 also included a break for $10,500 where a triple top now points to a near-term downtrend. The cryptocurrency has also seen a series of lower highs over the past month, with the latest pressure leading to a break to lows of $9,000, before climbing above $9,100 where it currently resides.

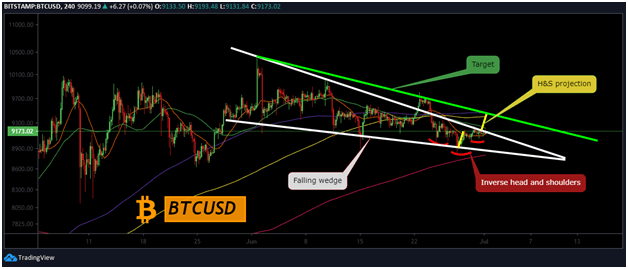

According to this chart, Bitcoin price has traded in a falling wedge and has recently formed an inverse head and shoulders pattern. A drop to new lows around $8,600 is likely. However, the chart suggests that prices can bounce to highs of $9450.

The chart also shows that Bollinger Band width is at March 2020 lows. The technical indicator is crucial as it points to low volatility in the Bitcoin markets — a sign that a big movement is likely to come soon.

Bitcoin’s consolidation phase over the past few weeks has included large volumes of short orders, as seen on the CME futures (Chicago Mercantile Exchange). With institutional traders holding more than 2,000 short positions in Bitcoin futures on the CME, the sentiment appears more bearish short term. The last time investors were this bearish about Bitcoin was just before the market crashed to $3,800.

BTC/USD daily chart

BTC/USD has been trading below $9,200 over the past 24 hours, with bears pushing the pair to lows of $8,981. A close at the $9,095 candle on the daily charts continued Bitcoin’s tough start to July.

As of writing, bears are looking to push prices lower, with trading down 1.07%. Bulls could gain the upper hand if the Elliott Oscillator continues to flash green heading into the European and US trading sessions. Also of note is that fact that the RSI has not flipped fully negative.

https://coinjournal.net/news/bears-look-to-pull-bitcoin-down-to-8600-as-bollinger-bands-tighten-their-squeeze/