According to data from CEX.IO, Bitcoin sat just below $30,000 at the end of 2020, with its price on New Years Eve closing at $29,033

It is mid-January, and both Bitcoin and Ethereum — the crypto industry’s two largest coins — have already seen significant price changes. There has been little regarding outside influences on the coins’ prices, but they still saw some strong shifts, likely influenced by the change in demand alone.

Bitcoin in January 2021

The recent Bitcoin price surge that has been leading the market rally has continued in early 2021, especially in the first 10 days of the new year.

According to data from CEX.IO, Bitcoin sat just below $30,000 at the end of 2020, with its price on New Years Eve closing at $29,033, with a daily high at $29,200. In the first two days of January, the coin has been trading sideways for the most part, but then, on 3rd January, saw a surge that took it up to $34,800.

This was a new all-time-high that the coin managed to maintain for around two and a half days. After reaching this level, BTC saw a correction to $30,000, which was followed by a massive new surge that started on 5th January.

The new price increase led the coin to a new all-time high of $41,500 on 8th January. While BTC dropped slightly after that, the real correction started around 10th January, when the coin started sinking, ending its drop at $30,333 on the next day.

The next five days saw BTC struggle to grow, and it even managed to surge to $40,100 again on 14th January. However, its price was rejected by the resistance at $40,000, which sent it back to the $34,400s. At the time of writing the coin is once again surging up and currently sitting at $37,428.

Ethereum in 2021

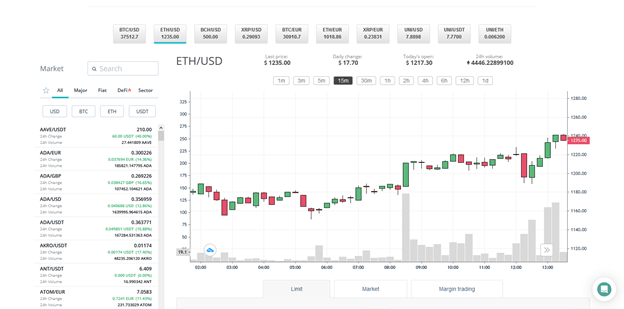

Ethereum has followed a similar path to Bitcoin, which is not that surprising, considering Bitcoin’s dominance in the crypto industry. Ethereum ended 2020 with the price of $737, while its daily high on 31st December was actually $744, according to CEX.IO data.

The first two days of the new year did not see much happen, and the coin has mostly remained where it was. Then, around 3rd January, its price surged up, breaching the $1,000 mark. Ethereum kept going up to $1,095, which it reached on 4th January.

After a small correction, Ethereum made another major leap upwards, hitting a new two-year high at $1,342 on 10th January. After that, it started seeing a strong correction, similarly to Bitcoin.

The correction took it down to $900 by 11th January, but that’s when traders started buying again, aiming to make good use of the dip. Ethereum was back above $1,000 by the next day, and while it sank below $1,000 one more time since then, it quickly recovered, never going below $988.

The coin then surged back towards $1,300, but hasn’t reached it so far. Instead, the highest that it managed to go to was $1,255, at least thus far. The 15th January saw another dip to $1,070, but today’s recovery had already brought it back above $1,200.

At the time of writing, the coin sits at $1,211 according to CEX.IO, with a daily volume over $35 billion. Meanwhile, its market cap is sitting at $138.4 billion, which is still far below Bitcoin’s $694bn.

What awaits Bitcoin and Ethereum in 2021?

When it comes to Bitcoin, the stock-to-flow model has been extremely accurate in predicting the coin’s future price action. 2020 brought Bitcoin’s third halving, which has typically been followed by a major supply shock. Not to mention the increased activity of institutional investors who have been buying the coin in massive quantities through intermediaries such as Grayscale and Microstrategy.

With that in mind, I expect Bitcoin to hit $50,000 by the end of Q1 2021, or by March 31st. This may happen before this date, given that the coin has already reached an ATH above $41,000.

As we go deeper into the year, the coin will likely continue surging up, and I believe that it could reach $80,000 by the end of Q2. Historical data shows that a drop in activity can be expected during the summer, which might be the time when a correction could take place. After that, I expect another surge in Q4, with the coin ending the year at the price of $90,000.

On the other hand, we have Ethereum, which has already surpassed $1,300 earlier this year. While the coin has retraced its steps since then, it will likely go back to this level by the end of Q1.

Unlike Bitcoin, Ethereum has not had the chance to hit a new ATH this year, mostly sitting on the sidelines, which is unusual, given all the activity its network has seen. With the project still leading in smart contracts, dApps, and DeFi — not to mention the early stages of its shift to Ethereum 2.0 — there is definitely a lot of room for Ethereum to grow down the line.

I believe that the coin could potentially even rise to twice its current price by the end of Q2, potentially ending the second quarter at $2,200. After the summer, the surge will take BTC to $90k and could also include Ethereum, especially if the history repeats itself, and the coin ends up being late to the party as it was in 2017/2018. By the end of the year, I expect it to come close to the $5k mark, possibly at $4,900.

https://coinjournal.net/news/bitcoin-and-ethereum-start-to-recover-from-11th-january-drop/