The proof is in the pudding when it comes to Bitcoin’s proof-of-work mechanism versus a proof-of-stake consensus mechanism debate.

There have been countless arguments surrounding both the proof-of-work (PoW) and proof-of-stake (PoS) as a means of gaining consensus on a blockchain network.

Many people have been asking themselves which one is better, and why? In this article, I’ll go over some of the main benefits and drawbacks of each consensus mechanism.

Let’s dive in.

What Is Proof-Of-Work (PoW)?

Proof-of-work is a decentralized consensus mechanism first introduced by Bitcoin (BTC). We will use the Bitcoin network as an example to understand the proof-of-work consensus mechanism.

The Bitcoin network essentially requires members to contribute computing power, such as graphics processing units, to solve arbitrary mathematical puzzles, and prevent anyone from gaining control or manipulating the system.

Every transaction that occurs is validated before it gets added to the blockchain. Each block then gets validated by the miners, who get rewarded BTC tokens as they have put in the “work” through their processing units. Hence, this is called proof-of-work.

The proof-of-work consensus mechanism has stood the test of time. This consensus mechanism has successfully validated billions of transactions on the Bitcoin blockchain for years and has maintained its authenticity and reliability as the most secure and decentralized consensus mechanism created till date.

What Is Proof-Of-Stake (PoS)?

Proof-of-stake (PoS) is a consensus mechanism used on blockchain networks created as an alternative to the PoW method for validating transactions.

In this mechanism, cryptocurrency owners can validate block transactions based on the number of coins the validator stakes (instead of miners validating them). Hence, this is called proof-of-stake (PoS).

The validators in PoS are chosen at random. To become a validator, one needs to stake a specific amount of cryptocurrency token required by that specific blockchain.

There are multiple variations of PoS, such as delegated-proof-of-stake (DPoS), etc. These have been developed and implemented across various blockchain networks, but they all mostly work in a similar way.

When a block of transactions is ready to be processed, the cryptocurrency’s protocol selects a validator to review the block. The validator then checks if the transactions in the block are fully accurate, and if they pass the checks, the block gets added to the blockchain.

In return for doing so, the validator gets rewarded in the form of cryptocurrency tokens for their contribution.

However, if a validator ends up proposing a block with information that is inaccurate, they lose some of their staked tokens as a penalty. This can happen in PoS as there is no hardware that solves cryptographic puzzles (unlike in the case with PoW).

Which Consensus Mechanism Is Better And Why?

Both PoW and PoS are designed to help the nodes on a blockchain network to verify all the transactions that occur.

Once the nodes agree on the validity of a block of transactions, the transactions get added to the blockchain. Both models offer distinctive methods to achieve the same end result.

However, proof-of-work as a system for validating transactions and securing the blockchain network is far more superior to a proof-of-stake (PoS) model, but it comes at a cost.

Below, I have discussed what makes PoW a superior consensus mechanism when compared to PoS, and the costs associated with it.

Security And Data Authenticity

PoW is more superior than PoS from a security and data authenticity perspective. This is due to the fact that in PoW, the data is connected to a proven history of human choices, which cannot cheat in a system that verifies every single transaction.

This system works with 0% trust, and 100% of the transactions are verified and recorded by the network participants on a public ledger.

PoW is also a highly secure consensus mechanism because over a period of time, it makes the network more and more difficult, to a point that it becomes unhackable — because the network is constantly monitored by its participants. These participants now have skin in the game (as they need to “work” to solve for transactions). This makes the network extremely expensive to hack.

On the other hand, the PoS consensus mechanism is more vulnerable to hacks and attacks.

In theory, if a network participant (or a group of participants) gets to a point of owning 51% of staked coins, this network participant (or group) could then essentially control the entire blockchain and alter it. This is termed as a 51% attack.

Network Ownership

Given the design of “mining” for getting rewards, the PoW model enables a decentralized structure.

Bitcoin is a great example of this. Bitcoin’s network is completely decentralized. No one person, entity or country controls it. It is owned and controlled by thousands of nodes running the network, in a decentralized and secured system, backed by PoW.

On the other hand, PoS enables a more centralized structure. The participants who can stake more (often the rich), in theory, can accumulate greater control just by staking more.

This is a risky proposition because if a group of participants eventually gets to 51% control, they can alter the blockchain to benefit themselves.

Haven’t we seen the problems with this kind of system already? Just open your eyes and you will see that we have been living in this system for a while now and look where it has brought us.

Incentive Alignment And Equity

The PoW model rewards miners when they solve complex mathematical puzzles — a block reward and a share of the transaction fees in some cases. This incentivizes the right behavior as the nodes are competing to solve the puzzle to get the reward.

The network keeps getting tougher and tougher, ensuring that solving these puzzles requires greater computing power. This in turn makes the entire network more secure and more expensive to hack or attack.

As the value of the cryptocurrency goes up, the value of the reward goes up. Every miner on the network has equal opportunity of earning the reward and in doing so, they continue to secure the network and make it robust.

This entire setup incentivizes the right behavior and discourages forking, which is the creation of an alternative blockchain when the protocol gets updated.

On the other hand, in a PoS model, the incentive for getting the reward is to just stake more. This leads to the centralization issue with participants staking more, potentially getting greater control of the blockchain. In an unmonitored blockchain, this incentive leads to a bigger security threat with less decentralization and more susceptibility to low-cost attacks.

Test Of Time

The PoW model has stood the test of time. The Bitcoin network is a great example of this.

In the last 13 years, the Bitcoin network has never been hacked or compromised in any way or form. It’s the world’s most powerful network and has stood the test of time from a network authenticity, reliability and security perspective.

On the other hand, the proof-of-stake models are relatively newer and remain in their early stages, both in adoption and implementation. Also, there is a higher level of confusion around the feasibility of some of these models as more and more variations are coming out that have not been fully tested.

Energy Consumption

There have been arguments historically that PoW models demand excessive energy consumption, which leads to increased costs and environmental impacts.

This is true. Indeed, a PoW model consumes a lot more energy than a PoS model.

This is due to the fact that as the difficulty of the network goes up, more and more computational power is needed to solve for the complexity. This is the cost of running a highly secure network.

A monetary network, which needs security at its core, does consume energy. Let’s take fiat currencies for example. Fiat currencies use a lot more energy than the PoW model, like the Bitcoin network would use.

This is because conventional banking backed by fiat currencies relies on paper money, which requires resources to produce them, and results in a lot of waste. When you factor in the energy costs of banks, high-rise office spaces, security vaults, security trucks, and other overheads, the traditional banking system is shown to be far more energy-depleting than Bitcoin.

A PoW model, like the Bitcoin network, doesn’t require any physical resources to produce, apart from the computational power needed to maintain the blockchain. So, while the Bitcoin network consumes energy, it’s still more environmentally friendlier than traditional banking and the fiat currency system that we use today. It’s a much better solution and an improvement of the energy consumption use case and an upgrade to the current system.

In other words, moving our monetary system into the Bitcoin network will not just be more efficient and secure, but will also be an essential step in fighting against global warming.

PoW is a superior system (as we discussed earlier) and it is incentivizing innovation and creativity in the energy consumption space as well.

PoW energy consumption has been heavily optimized throughout the past few years and uses renewable energy, and energy that would have otherwise been wasted.

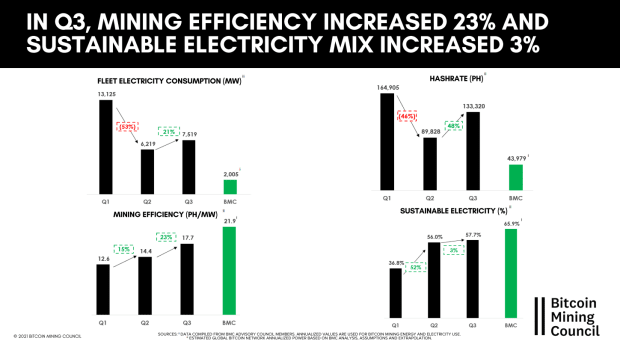

Let’s take the Bitcoin network for example. According to the Q3 Global Bitcoin Mining Data, a majority of the mining done on Bitcoin is through renewable energy.

In fact, Bitcoin mining energy use is only 0.122% when compared to the world’s total energy. According to the report, in Q3 of 2021, mining efficiency increased by 23%, and sustainable electricity mix increased by 3%.

In fact, Bitcoin mining has increased 43X in efficiency within the last seven years. In other words, its mining is 4,237% more efficient now than it was seven years ago.

This report concludes that the Bitcoin Mining Council has estimated a 3x and 2x improvement in the mining efficiency over the next four and following four years.

So not only is it the most efficient usage of energy today (for the application of a monetary system), it is guaranteed to be dramatically more efficient within the span of the next eight years.

The rewards for mining Bitcoin are high, which incentivizes miners to look for alternative energy sources, leading to innovations in renewables. Since most of the cost of mining Bitcoin goes to electricity, miners are driven to find the cheapest, cleanest source possible to maximize profits.

In fact, Bitcoin mining could be said to be one of the greenest large-scale industries globally. Most of the largest mining outfits are located in regions where renewable electricity is abundant. Renewable energy sources are becoming more and more popular, as they are cleaner and cheaper than traditional forms of energy.

Many experts believe that the future of renewable energy is bright and will eventually overtake conventional forms of energy. Bitcoin mining is leading this charge.

The energy consumption of Bitcoin is a small price to pay, considering the economic and social value that it provides. Bitcoin is worth every bit of energy needed to keep it going.

Conclusion

When you look at all the benefits and costs of a PoW model, you realize that the benefits of the PoW model far outweighs the costs.

PoW is a superior system due to the fact that it is fair, secure, and ensures incentives that are aligned with the goal of the blockchain network, to secure each transaction.

PoW energy consumption has been heavily optimized throughout the past few years and uses renewable energy or energy that would have otherwise been wasted.

Bitcoin is backed by the PoW consensus mechanism and has stood the test of time over the last 13 years. This alone is proof of how effective and powerful the PoW consensus model is.

A network built on equity, security, decentralization and proof-of-work consensus mechanism is engineered to thrive.

This is a guest post by Mir Quadri. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.