The decentralized finance (DeFi) space has come under renewed pressure over the past few months. Data from DeFi Llama has shown that the TVL locked in DeFi has plummeted from a staggering $250 billion to $70 billion, with most DeFi tokens shedding nearly 80% of their value. This has led to serious concerns that DeFi may have run its course and is probably on its last legs.

The challenges faced by the DeFi ecosystem have been well documented. Still, the collapse of several DeFi projects has reinforced the idea that DeFi, at least in its present form, is broken.

DeFi And Its Problems

Decentralized applications and protocols created on blockchain technology facilitate open, trustless, and peer-to-peer transactions. The primary goal of the DeFi ecosystem is to offer users permissionless lending and borrowing services and access to yield-optimizing solutions.

While DeFi adoption saw a significant initial spike, with users drawn to blockchain-based financial products and services, it comes with its problems. The first and most prominent one is high transaction costs. Most DeFi projects are based on the Ethereum blockchain. The implication of this is a significant increase in transaction fees due to congestion on the network, with users trying to access the different DeFi applications on the platform.

The DeFi ecosystem also has a liquidity problem, leading to an inefficient market. DeFi has adopted several models to address the liquidity issue, such as liquidity pools incentivizing users to deposit their assets and earn rewards. However, this approach has limitations, is risky, and is dependent on token holders who may or may not act in the best interests of the protocol.

Another problem is interoperability. Blockchain networks are, by design, different, with each offering different access controls, consensus protocols, designs, and asset definitions. However, these capabilities exist in isolation, making it difficult for users to move value from one blockchain to another.

Additionally, the emergence of a variety of scams due to lax regulations and the collapse of Terra have also left a significant negative impact on the DeFi ecosystem.

DeFi Can Still Recover

However, experts believe that DeFi can be revived through simple yet decisive steps.

Improved Usability

DeFi features a complicated onboarding process and user interface. Additionally, staking features confusing steps, which could overwhelm even experienced users. User experiences with most platforms are often subpar, and a better system to educate users and a more user-friendly experience could be hugely beneficial.

Security

The DeFi ecosystem has had its fair share of security issues, with numerous hacks that have seen liquidity drained from protocols. Experts feel a higher level of security from malicious entities and protocol exploits is essential for the DeFi space to thrive again.

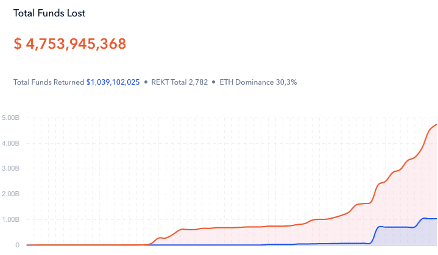

According to the REKT Database of cyber-attacks, DeFi protocols have lost $4.75 billion in total due to scams, hacks, and exploits. Out of $4.75 billion lost, only $1 billion was returned. Only 21 percent of all the funds lost due to cyber-attacks have been recovered. Today, REKT Database has reports of 2,782 attacks

Total funds lost due to DeFi hacks since 2012

Regulation

One of the most critical steps is regulatory clarity. Yes, DeFi is all about freedom from the regulations that bog down centralized finance.

A copy of the still in-progress Digital Commodities Consumer Protection Act (DCCPA), which outlines how the Commodities Futures Trading Commission would regulate the crypto industry, was uploaded to GitHub today.

The latest draft appears to cushion language perceived to be detrimental to DeFi — a category of blockchain-based solutions that aim to improve finance by replacing central intermediaries with software code.

It lays out what constitutes digital commodities, brokers, custodians, dealers and platforms. Also included in the document are rules and the core principles that apply to players in the digital commodities sphere.

I have long been a believer in transparency and open discussion of the future of cryptolaw.

Accordingly, I have obtained a copy of a draft of the notorious DCCPA circulating secretly in D.C. and am hereby making it available to the public. https://t.co/JdyomquQi6

— _gabrielShapir0 (@lex_node) October 19, 2022

Web3 startup accelerator Alliance DAO disparaged the DCCPA bill, “saying it forces human intermediation and compels projects to sacrifice decentralization”

The DCCPA greatly threatens DeFi innovation.

The proposed bill:

– gives CFTC new powers to regulate spot markets

– forces human intermediation

– forces projects to sacrifice decentralizationIt favors centralized incumbents and kills startups.

Alliance opposes the DCCPA. 🧵

— Alliance 👽 (@alliancedao) October 19, 2022

Summing Up Is DeFi Dead?

So is DeFi dying? No. While it may be going through a bit of a crisis, the community can take steps to bring back confidence into the space. Addressing prominent issues with the DeFi ecosystem is critical in bringing back user confidence in the DeFi ecosystem

The post Is DeFi Dead? Tokens Crashing nearly 80% of their value appeared first on Blockgeeks.