Brendan Bernstein is a founding member of Tetras Capital Partners, LLC, an investment manager focused on investing in cryptocurrencies and blockchain assets.

Cryptocurrency investors are blind to the most important factor of any investment – valuation.

Merely uttering the word “blockchain” has been a hypnotic weapon, sending investors into a trance where they clamor to buy at any price.

Tea cup from Get Out: The process of sending blockchain investors into hypnosis.

Raiblocks investors in “the sunken place.”

This isn’t the first time growth investors have gone wild. Technological innovation typically turns investors into emotional basket cases. Today, a blockchain protocol with any facade of technical aptitude is valued at eight figures.

Throw out a $10-term like “DAG” or ‘interoperability” and you’ll get nine figures.

And these low eight- or nine-figure valuations are turning into 10-figure valuations. Wash, rinse, repeat…. The blockchain voodoo is working.

Blockchain investors using jobu to increase protocol valuation.

Well, for people who view tokens as a casino chip instead of an asset who’s value will ultimately converge to fundamental value….

Spoiler alert: this won’t end well.

Crypto assets are “different”…

Hiding behind the pseudo-science of white papers and platitudes like “decentralized technology bringing a new era,” many investors believe crypto assets are “different.” If transactions increase, the protocol will go up in value…

History tells us it can’t be that simple.

The “Nifty Fifty” of the 1960s, a group of 50 stocks that represented some of the fastest-growing companies on the planet, bought regardless of price, epitomizes a case of growth investing gone wild. The goal of the approach was to identify companies with the most optimistic outlooks in earnings growth. The stocks that highlighted “America’s great stocks” lists were Xerox, Kodak, Motorola and Texas-Instruments.

These stocks were meant to be bought and held, not sold. As a result, investors disregarded valuation. The prevailing mentality was that “even if the asset is expensive today it will grow into its price.”

“Hold!” they said. The resulting P/E ratios in 1972 are shown below.

What do you notice about the names above?

The spectacular growth abruptly came to an end for many from technological obsolescence and competition. P/E ratios for the 50 stocks selected collapsed to 10. By 1975, the Nifty Fifty had shed two-thirds of its value.

Newly conceived ICOs are raising at valuations in the hundreds of millions and the same venture investors that would scoff at a $500 million valuation in the “real world” are lining up to buy tokens with no recourse and without any regards for valuation.

Valuation is the least important factor instead of the most. And as a result, there are 24 early-stage crypto assets with a valuation over $1 billion, most of which only have one value proposition: speculation.

If you were planning to buy a new house, hopefully you’d ask what the price is. But instead, just like with housing leading up to 2008, blockchain investors have been lured into believing that growth alone obviates any need for valuation rigor.

When price starts to diverge from value, and growth at any price becomes the general market sentiment, risk adjusted returns fall dramatically. Crypto investors will ultimately need to have a strategy, other than selling the token to a greater fool.

The long-term crypto investor

The most important factor driving an investment success or failure is the relationship between the price you pay and the asset’s worth. A fundamentally strong asset can be a bad investment if too optimistic of expectations are priced in and vice versa.

What tends to get investors into trouble is conflating “interesting asset” with “interesting at any price”. I’m fascinated by the vision for a “world computer”. But that alone doesn’t mean Ethereum is a high expected value bet at a $100 billion valuation.

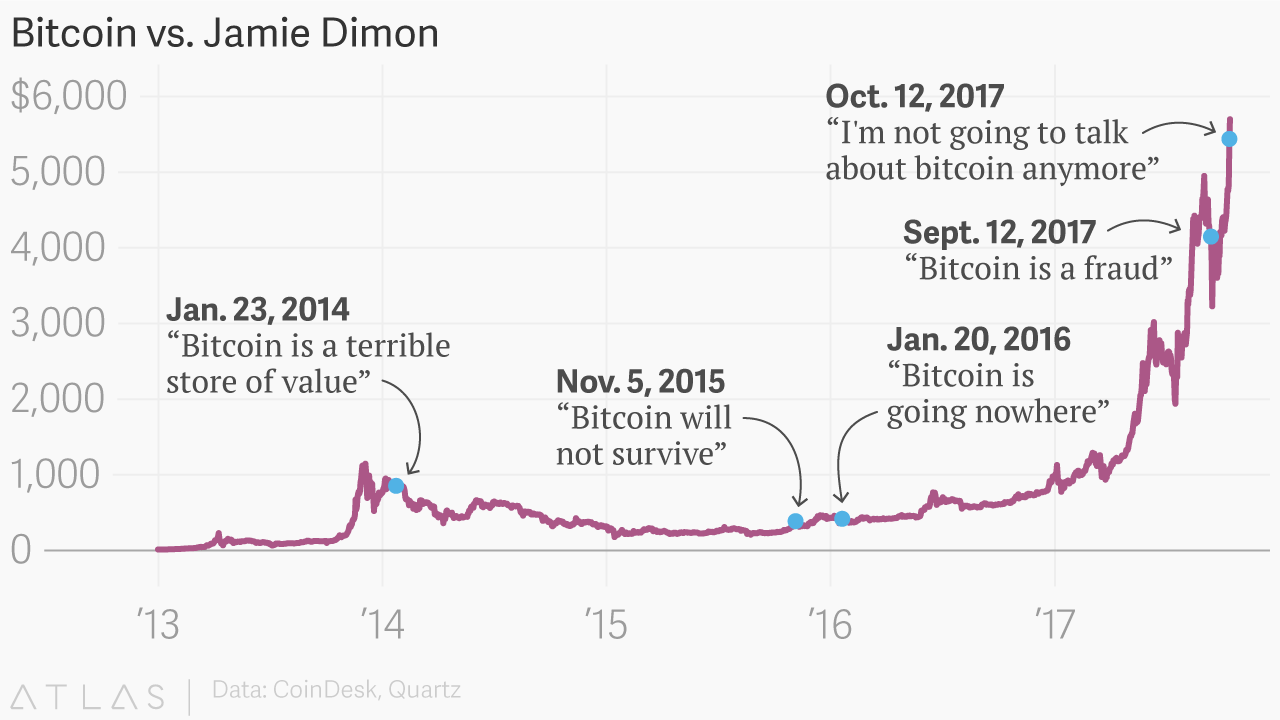

Objective merit alone is about as good of a predictor of price increases as Jamie Dimon’s forecasts are.

There are two fundamental investing approaches that warrant dissection: value and growth. Value investors look to buy the proverbial one-dollar bill for $0.80. Growth investors look to buy a one-dollar bill that can turn into a fancy new bio-tech drug or consumer application worth $5 10 years down the road. Either strategy can work.

But regardless, both schools of investors still need to accurately price and understand what constitutes “low” and “high” for any given asset. If the asset purportedly worth $1 turns out to be worth $0.25, both investors are overpaying and reducing risk adjusted returns substantially.

Generally, the early stage investment realm is dominated by growth investors due to the difficulty of determining present fundamentals.

Due to the future uncertainty, growth investors like venture capitalists typically require a higher rate of return to compensate them for the risk. According to CB Insights, only 0.91 percent of startups make it from seed stage to greater than $1 billion in value.

Thus, seed valuations need to be more than $10 million ($1 billion multiplied by 1 percent) and returns need to be higher than 100x for the bet to be expected value positive at that failure rate (100x multiplied by .$01 = 1x money). (This is a slight oversimplification but helpful for purposes of this analysis).

The bottom line is that the initial valuation matters and needs to compensate you for the risk.

Many crypto assets are undoubtedly riskier – you’re trading the preferential rights and recourse of an equity investment for a tote bag and a token with an unproven value capture mechanism.

In fact, according to Fortune, 60 percent of ICOs have already failed after just two years – talk about not wasting any time. Required return, or the discount rate, needs to be higher for crypto assets to generate a positive expected value. Given the increased risk, you’d think crypto valuations would be lower than early stage venture capital but instead they are order(s) of magnitude higher.

Because valuations are already in the hundreds of millions, investors need conviction that these protocols will ultimately be worth tens of billions to generate a substantial risk adjusted return (10x-50x required return multiplied by hundreds of millions = $billions).

For those already worth billions the challenge is clearly magnified. Billions of dollars of value capture is not in and of itself a problem. But in crypto it will be for many assets because the only way that a crypto asset can be worth tens of billions of dollars is if it becomes a reserve store of value.

This is a non trivial task, to say the least. Let me explain…

Reserve stores of value

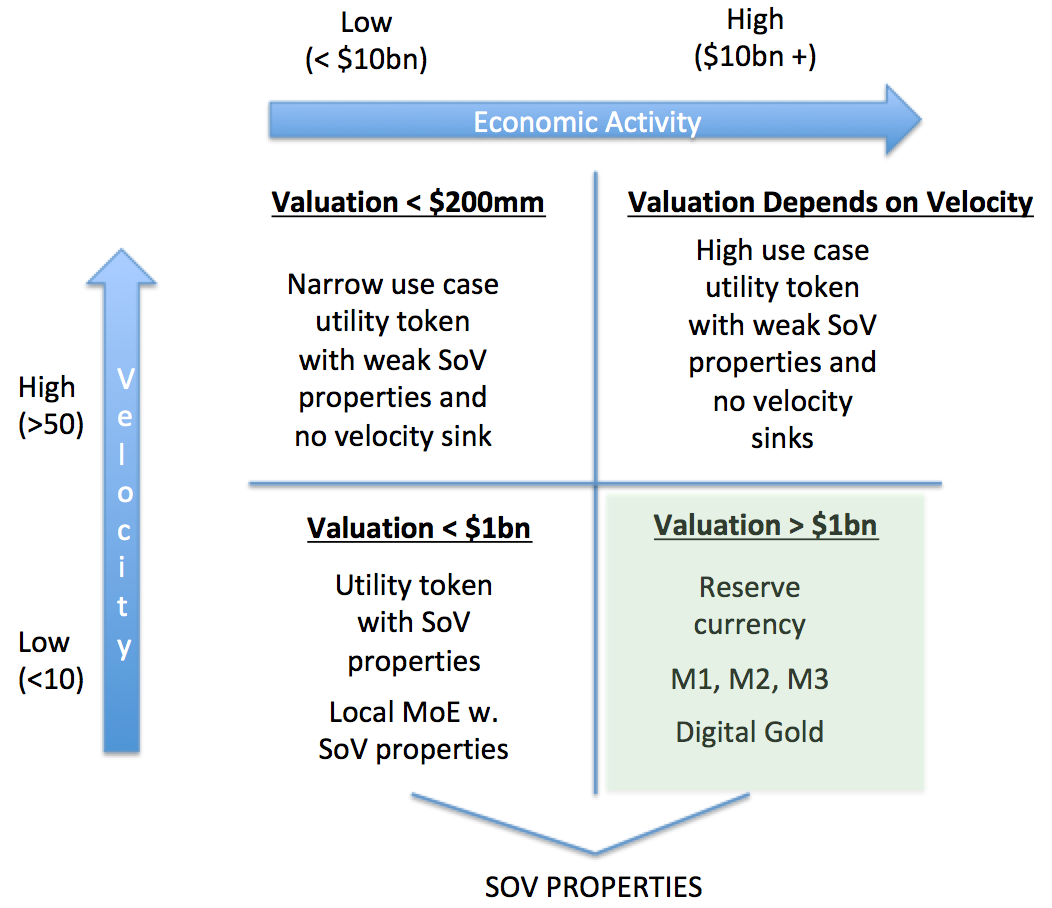

The key to ascertaining fundamental value in crypto is an understanding of [1] economic activity – transactional usage of the token + the store of value component and [2] velocity – how frequently the token changes hands.

The matrix below helps me think about value accrual along these two dimensions using the quantity theory of money – the best framework to reason about currency and token valuation today:

This matrix paints the picture that the only way an asset can ultimately be worth more than $1 billion is if it is in the bottom right quadrant: High economic activity and low velocity. ($10 billion divided by 10 = $1 billion market cap)

Every other quadrant is relegated to the world of nine figures, largely because of the importance of velocity.

Recognizing the importance of velocity, there’s been a lot of work done to manipulate it through relatively complex mechanisms. However, I tend to agree with Nic Carter below on most “solutions” I’ve seen.

I think “velocity sinks” and the field of “tokenomics” are just sugar-coated synonyms for the more mundane idea of ensuring returns for token backers. Of course, nothing is free, and many of these schemes will end in tears.

— Nic Carter (@nic__carter) February 7, 2018

If users are reluctant to hold the token, in more cases than not, there’s no escaping the high velocity that will ensue.

And in the long run, with the proliferation of seamless decentralized exchanges and atomic swaps, the only assets I believe individuals will be comfortable holding a substantial amount of wealth in are those that satisfy the properties of a store of value.

Thus, if you subscribe to the view above, the conclusion is that for a token to have a valuation of above $1 billion it must [1] be a store of value and [2] have substantially greater than $1 billion in wealth held due to the velocity problem. A tall order for most assets in the space, but they’re definitely not priced like it.

Below is a simplification of the matrix above with the additional insight:

If you’re investing in an asset today with a valuation in the hundreds of millions, to generate a positive risk-adjusted return you need those millions to turn into billions. Because only reserve stores of value will be worth billions, you’re implicitly betting that the asset becomes one.

The issue is compounded if the crypto asset is already worth more than $1bn. Even if it becomes a store of value the return may not be sufficient given the high risk. It all comes down to the initial valuation paid.

Warren Buffett, per usual, puts it best:

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments. ”

– Warren Buffett, 1982 letter to shareholders

An understanding of these facets will open your eyes to the insanity of crypto valuations.

Slight caveat: This analysis doesn’t include security tokens that are more similar to equity and given the recourse can be worth greater than $1 billion.

Most assets won’t become a reserve store of value

Becoming a store of value is not trivial. The best reserve store of value must secure purchasing power over an extended period of time. Let’s break that down.

At the very least, money must first be secure. If security is a concern, high mental transaction costs will prevent its adoption; social scalability is eliminated (a big reason why FDIC was instated, for example). A store of value cannot be vulnerable to replay attacks, buggy smart contracts and double spending.

And because code is bound to have bugs, the development needs to be conservative and only prioritize crucial features. The development needs to be a complete meritocracy – errors cannot be tolerated.

A sound money and reserve store of value must also retain its purchasing power. There needs to be strong predictability to the supply, which guarantees to holders that they will not witness a drop in the purchasing power of the currency. It needs to be highly durable, thus cannot be arbitrarily changed or devalued by a centralized monopoly.

In the case of gold, for example, the durability is guaranteed by its physical characteristics and cost of extraction.

What enables the above in bitcoin and cryptocurrencies is the peer-to-peer architecture and decentralization. Decentralization, as defined by Paul Sztorc is the cost of the option to run a new full node:

“The requirement to run an entire full node may seem like a high bar, but the height is appropriate. With money, other people’s actions (counterfeiting) affect you. The only way for you to know you’ve been paid, is to make sure that every piece of data has followed every rule, and you can’t do that unless you have all of the data, and all of the rules, in front of you. That’s a full node.”

The cheaper the option to run a full node, [1] the less users need to rely on trusted parties to audit when they’ve been paid and [2] the greater the checks and balances against arbitrary rule changes to the system. Together, this allows the durability, censorship resistance and trust minimization that is so critical to reserve store of value functionality.

A lot to ask for. And why, 99 percent of tokens won’t ever satisfy the store of value pre-requisites.

You’ll also notice that usage as a medium of exchange and dAppp functionality is not listed as a prerequisite. There are two diametrically opposed tradeoffs between security and usability at the base layer. The more complexity at the base level, the larger attack surface and higher the cost of the option to run a full node. If the cost becomes prohibitive, users need to completely rely on a trusted third party to verify transactions.

The more we reduce the P2P nature of blockchains, the “easier it will be governments to cut off their heads.”

Source: Truthcoin

Said another way, base layer trustlessness is a necessary condition for a reserve store of value and layer-one transactions and feature richness are not.

Without trustlessness, blockchains start to act a lot like our status quo institutions and they will end up more like a decapitated Napster or our current inflationary monetary system than a reserve store of value. To wrest control of money out of the hands of centralized institutions and live to tell the tale, decentralization is absolutely paramount. If the money you save can be destroyed, there’s no point to doing so.

Job one is to stay alive.

However, individuals are willing to accept various degrees of trust. Ultimately, as holders start saving the reserve store of value, out of convenience they’ll transact in it through second layer solutions that are less trust minimized. But the base protocol first needs to cement itself as secure, trust-less and decentralized. Then and only then can it add all of the fun stuff on top. The low entropy base chain allows the higher entropy use cases to flourish.

The question to ask about every crypto asset is why individuals would hold their wealth in anything other than the most objectively secure, trust-less and censorship resistant asset with the soundest monetary policy.

Ethereum as a store of value

Analyzing ethereum is a helpful case study as it straddles the borderline between a pure utility token and store of value.

It’s possible to justify ethereum’s current price as either under or overvalued – and it all comes down to whether it becomes a reserve store of value. Even though ethereum’s core value proposition is not to be a “digital gold,” it effectively needs to become one to generate a high risk-adjusted return.

And the same quandary holds true for bitcoin cash and many other assets. How’s that for irony?

The first analysis below projects out ethereum returns in the case it doesn’t become a reserve store of value, using the quantity theory of money.

Slight caveat: Economic activity should also capture MoE payments. For simplicity of this analysis, the sheer magnitude of the upside in activity should capture this.

Even with a 1000x increase in economic activity from $350 million – $350 billion from 2018-2021, the price of the token actually decreases by 90 percent. Because the price is 8.5x overvalued based on actual circulating market cap today, the growth in usage does not bail the investor out for the high price paid.

As the speculation premium contracts and velocity increases, the price will contract to an equilibrium value at a fraction of the total economic activity.

(Despite the precision above, the quantity theory of money is best thought of as a framework to understand which tokens will accrue value rather than a precise valuation mechanism.)

If, on the other hand, ethereum becomes a reserve store of value the valuation is relatively more compelling. The oft-quoted comp for a reserve store of value is gold at a ~$7 trillion market cap. The question is, what is the probability of it doing so? Extremely low, in my opinion.

Ethereum has three main use cases today, none of which bolster the store of value argument: (1) crowdfunding platform, (2) crypto kitties / digital collectibles platform and (3) a platform for hackers to hack each other.

The complexity of the base blockchain materially detracts from ethereum’s potential use as a store of value. The rich statefulness increases the attack surface. And if the “world computer” actually works, a full node is effectively the equivalent of running every computer operation in the world on one server. Imagine having to verify every single Uber trip, Dropbox transaction and poker hand on your computer to ensure the current state was accurate.

Dapps aren’t even live yet and the cost of running a full ethereum node is increasing dramatically. Unless ethereum considerably changes its architecture, users will ultimately be forced to rely on trusted third parties instead of running a full node themselves – and we unfortunately know all too well that “trusted third parties are security holes.” For certain use cases this may not be an issue – but for a reserve store of value it’s absolutely intolerable.

Vitalik helps to clarify this conflict between store of value and medium of exchange use:

“In the case of pure cryptocurrencies like bitcoin, store-of-value use (“hodling”) and medium-of-exchange use (“buying coffees”) are naturally in conflict, as the store-of-value prizes security much more than the medium-of-exchange use case, which more strongly values usability. With ethereum, the conflict is worse, as there are many people who use ethereum for reasons that have nothing to do with ether (see: cryptokitties).”

The story doesn’t end there: The vulnerability and security of assets held on a Turing-complete protocol, rich statefulness of the base blockchain and high political centralization also detract from the store of value thesis. And the lack of clarity around the monetary policy is an absolute deal breaker.

If users are not certain that [1] their purchasing power won’t be arbitrarily reduced in the future and [2] their funds are secure from buggy code and censorship, savings and liquidity will both be stifled.

With that being said, I don’t want to pretend that the investment world is binary. The key is applying a probability to each potential outcome and deducing the expected value of various opportunities. At the right price, an unlikely bet can still have positive expected value. The issue is when prices no longer compensate you for the risk.

Valuations will inevitably exert their gravity

This essay is not saying that non reserve store of value crypto assets will always be bad risk-adjusted long-term investments. But just that it’s the case today because most are valued greater than $100 million. Early-stage crypto experiments are valued like later-stage successes. The only way to grow beyond the valuations is through becoming a reserve store of value.

When asset valuations drop by a couple orders of magnitude after investors inevitably regain their sensibilities, the equation will be entirely different.

But for the meantime, navigating this cryptocurrency environment will require a fundamental perspective shift. Given where valuations are today, usage and objective merit alone are not predictors of success.

The protocols that generate long-term returns may not necessarily be the ones with the best teams and highest chances of transactional adoption, but instead those that can potentially become a store of value, where the price paid compensates you for the probability of it doing so.

Disclaimer: The comments, views, opinions and any forecasts of future events reflect the opinion of the quoted author or speaker, do not necessarily reflect the views of Tetras Capital Partners, LLC (“Tetras”) or other professionals at Tetras, are not guarantees of future events, returns or results and are not intended to provide financial planning or investment advice.

Money and calculator via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

https://www.coindesk.com/making-sense-crypto-asset-valuation-insanity/