June 24, 2020

By Benson Toti

As DeFi lock-in in Ethereum averages $14M each day, the total fees of the second-largest crypto network remains above that of Bitcoin

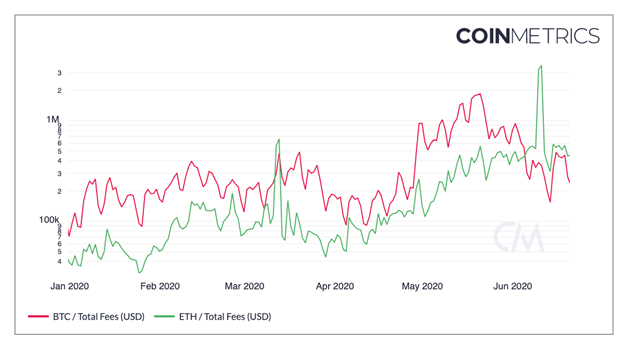

Ethereum’s daily transaction fees have been surging above Bitcoin’s for two consecutive weeks. After Korea-based P2P platform, Good Cycle, inexplicably paid $2.6 million in fees — total fees on the Ethereum network flipped Bitcoin’s and has stayed above it since June 10.

According to data provider CoinMetrics, the last time Ethereum’s fees went above that of Bitcoin for two weeks running was in July 2018.

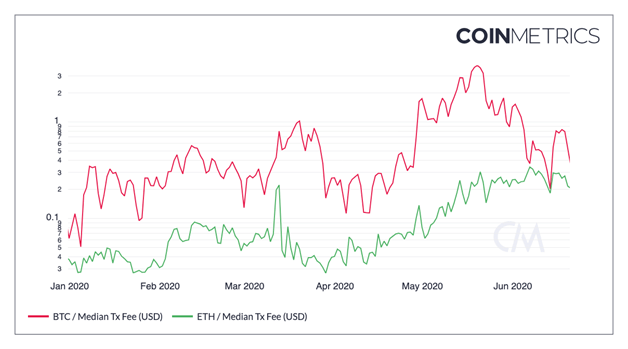

Network fees for Bitcoin have been between $1 and $1.50 in the period, whereas Ethereum’s median fee has fluctuated between $0.47 and $0.65.

$14 million worth of ETH locked in DeFi every day

Decentralized finance (DeFi) protocols take about 0.42 million Ethereum tokens each day, with the average total value locked in ETH over the past seven days totalling 2.949 million ETH.

As per data on DeFi Pulse, the total value in US dollars locked in by DeFi over is $1.6 billion. Of this amount, over $500 million entered the ecosystem over the past seven days alone. The average daily lock-ins is therefore around $78 million.

A vast majority of this is in DAI tokens, but Ethereum has seen a significant increase in the amount of its native token locked into protocols like Maker and Compound.

Calculated on the prevailing price for ETH/USD, the daily lock-in of 421,000 Ethereum tokens comes to over $14 million sent to DeFi each day — showing growing potential for the space.

In comparison, Ethereum’s daily issuance through mining generates about 15,483 Ether every day. At prevailing market prices, mining generates about $3.74 million worth of the token every day.

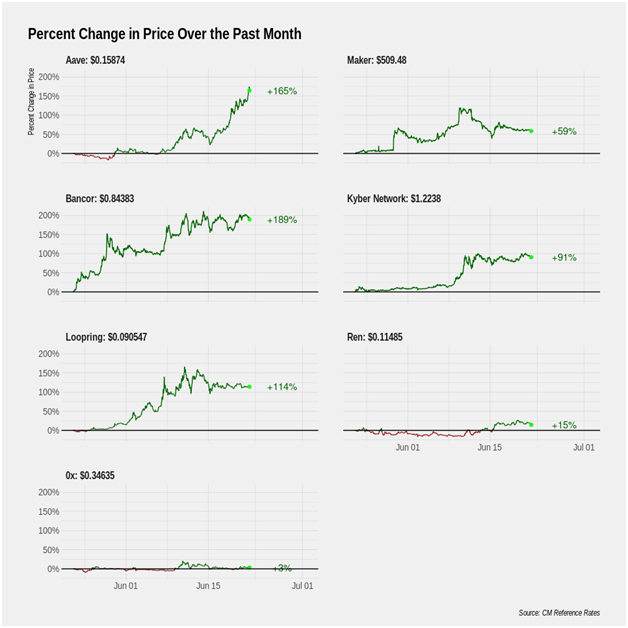

DeFi tokens have seen their value spike in the past week, with COMP/USD over 180% up since Thursday. Other tokens have also surged in this period, as shown in the screenshot below.

Ethereum currently trades at $242, with bulls fighting to prevent a break below $240.

https://coinjournal.net/news/ethereums-fees-remain-above-bitcoins-for-second-week-running/