July 22, 2020

By Benson Toti

Vechain and NEO have both gained by more than 6% in the past 24 hours, with VeChain’s ToolChain being piloted by over 300 companies in food tracking

NEO and VeChain are topping the gainer’s charts among the top altcoins, after recovering from recent dips.

VeChain recently failed at cracking resistance at $0.019, with sell-off pressure pushing it to a low of $0.015. Things are looking up as the broader cryptocurrency market recovers, traders buoyed by an uptick in Bitcoin’s price.

Positive news for VeChain comes from Italy’s farming giant Coldiretti and multinational food processor Princes, which have recently announced they will integrate VeChain’s ToolChain in a DLT pilot. The massive project will bring together 300 companies, and will seek to use VeChain to track farm produce.

NEO has also gained in the last 24 hours to leave bulls eyeing a run to $13.00 in coming trading sessions.

VET/USD

VeChain’s VET currently trades at $0.0175, up 6.6% in intraday trades. As of writing, VET/USD has recouped most of the losses posted in the week and bulls will eye a daily close near $0.018 to sustain the uptrend.

Looking at the charts, the 20-day moving average is the target in the 4-hour timeframe. VeChain will confirm a bullish case if there’s a run to the 50-day MA at $0.0181, which is likely given the upturned RSI. Further upside will take the price to the psychological $0.020.

A breakdown has local support at $0.0161 provided by the middle line of the parallel channel and the Bollinger Band. Increased sell-off would see bulls rely on support at $0.0160 and recent bottom at $0.0157.

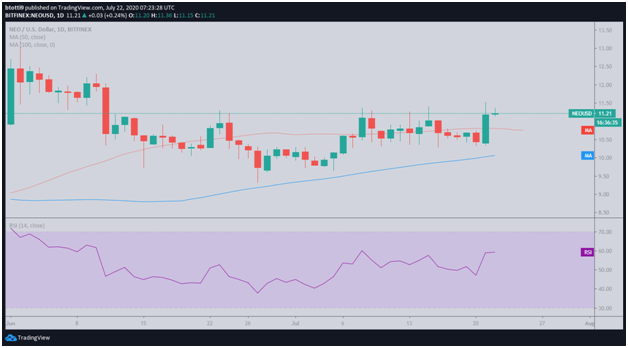

NEO/USD

NEO/USD is up 6.5% on the day, the biggest gainer among the top 30 cryptocurrencies on Wednesday. The altcoin has touched an intraday high of $11.46 and currently trades at around $11.21.

The upside has health support at two key moving averages- the 50-day simple moving average at $10.80 and the 100-day SMA at $10.07. Additionally, NEO/USD is trending above the upper boundary of a descending channel and bulls are likely to eye a close at $12.00.

The technical picture however suggests that buyers might hit seller congestion around $13.00. A flatlining RSI on the daily timeframe needs to bounce higher to support buying pressure during later trading sessions.

https://coinjournal.net/news/vechain-and-neo-are-top-gainers/