The new protocol in the block has achieved an impressive milestone after unlocking a total value locked of $1 billion in less than six weeks of launch

The recently launched DeFi yield platform Vesper Finance topped a total value-locked figure of $1 billion earlier this week. Co-founded by Jeff Garzik, the protocol achieved this feat in less than two months of launching on mainnet.

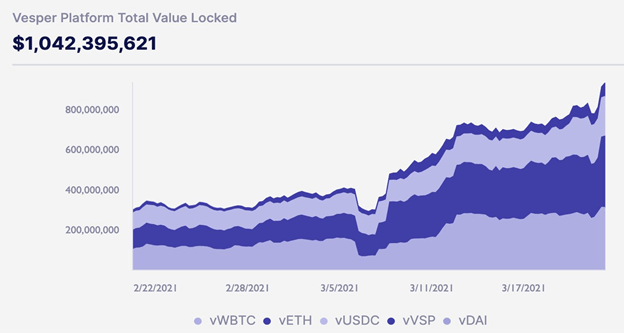

During its beta stage that lasted for about eight weeks from the end of last year to February, Vesper Finance’s ecosystem accrued about $25 million. By the first week of March, the DeFi project had sight of a total value locked of $500 million. This figure has since doubled in just two weeks.

The DeFi project features a suite of yield-generating products, including USD coin (USDC) with an earning rate of 13.78%, Ethereum (ETH), which has an earning rate of 0.12% and Wrapped Bitcoin (WBT) with an earning rate of 0.01%. There is also a native asset VSP base with an earning rate of 73.46%.

Yesterday, Vesper Finance shared an image post showing the rapid increase in total value locked on Twitter.

Its epic run in the last two weeks has brought it on the radar of many traders like Tyler Swope, who described it as the most undervalued altcoin. The YouTuber told his subscribers on Saturday that it was the token to watch out for. At the time, Vesper Finance had a total market capital of less than $90 million, while the total value locked in the protocol stood at $750 million.

Garzik, a former Bitcoin core developer, posted the news and added that Vesper Finance open-sourced its smart contracts.

“As Vesper crosses the $1B deposit milestone, we wanted to present the test framework and modularity behind the [already open] smart contracts,” he wrote. “Another #OpenSource #Ethereum #DeFi component is our #NFT container. This is a transferable NFT, which can hold any amount of ERC20s and NFTs. It is used to package, transfer, auction a distinct, auditable financial and non-financial assets.”

The project sits in 10th place above InstaDapp on DeFi Pulse’s list of the largest DeFi projects with a total value locked of $1.12 billion – up 7.8% in the last 24 hours.

https://coinjournal.net/news/vesper-finances-total-value-locked-eclipses-1-bn/