The 51% attack on Bitcoin SV this week is an opportunity to highlight the importance of decentralized blockchain security.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The altcoin Bitcoin SV was 51% attacked earlier this week, and thus arose an opportunity to highlight the importance of the security model for “decentralized” blockchains. This tweet thread from Lucas Nuzzi does a great job of explaining what occurred.

The notions that bitcoin is “too slow” or that it doesn’t have “enough transactions per second” to be global money that many proponents of altcoins have championed over the years are based on incorrect assumptions and understanding of how blockchains work and what they fundamentally solve.

First, what is a 51% attack?

A 51% attack is when an entity acquires a majority share of a network’s hash rate, they can maliciously double spend coins. Due to the Bitcoin network defaulting the longest chain of blocks, a 51% attack is only possible if the attacker can continue to produce blocks at a faster rate than honest miners.

“The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes…. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes.” – Satoshi Nakamoto, “Bitcoin: A Peer-to-Peer Electronic Cash System”

In the case of Bitcoin SV, the security model is especially compromised for two distinct reasons in particular:

- Due to the monopolistic nature of proof-of-work networks, it is often uneconomical to sell hash power for forks. Less security, less liquidity, less users, etc. Network effects matter.

- Because Bitcoin SV (a fork of Bitcoin Cash) further expanded the blocksize to that of 100 times the size of BTC, there are little to no transaction fees on the network, further decreasing the incentive to sell hash power to the network. As the supply issuance of bitcoin (or any of its forks) trends to zero in asymptotic fashion, transaction fees will pay for the entire security model of the network. This is unsustainable for networks like BSV.

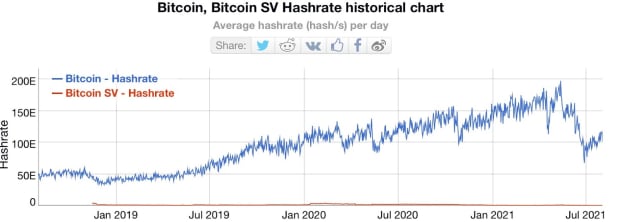

Below is the hash rate of BTC and BSV charted together (in both logarithmic and linear view for perspective):

Those who believe a blockchain can scale by simply multiplying a concept across the network have a fundamental misunderstanding of how a decentralized blockchain can scale. Bitcoin SV is a classic example of that. Proponents of BSV would state how “fast” and “cheap” transactions were on the network, but the reality is there are always tradeoffs. Users of BSV ultimately were choosing inferior security and settlement assurances.