Although things may seem objectively bad right now, there is reason for hope.

A gloomy outlook on the future is understandable, given the events of the past 18 months. But when we consider things from a wider perspective, we find that this is the best time in history to be alive. And it’s about to get much better, as with Bitcoin we have a chance to solve mankind’s last big problem.

Imagine being born in 1920s Czechoslovakia. If you can’t, because you are not familiar with the country’s history, let me paint you a picture of what your life would look like.

The Bad Old Days

Your childhood in the optimistic post–World War I era would be joyful, but these good years would be short lived.

In your adolescence, you would witness your parents’ rising fear of global economic depression and the subsequent rise of Adolf Hitler to power in neighboring Germany. During the Nazi occupation in 1939 to 1945 you would become a slave in the war factories. Some of your friends — still kids — would die due to the atrocious conditions.

There would be a few good years after the war. Though your home country was ravaged and lost most of its gold to Nazi plunderers (happily assisted by the Bank of England and the Bank for International Settlement), at least it was finally free. However, any optimism would be quickly ground under a communist boot, when the Moscow-directed Communist Party of Czechoslovakia seized power in 1948.

But you would adjust. In the early 1950s, you would have a job, a family and some savings built up. Those savings would be promptly taken from you in the 1953 monetary “reform” — which was actually a huge redistribution scheme to stomp out any remnants of the middle class. Since you weren’t in the Communist party — due to principles that your parents instilled in you — you would bear the brunt of the reform and would be left with almost nothing.

The 1950s and 1960s would be hard. You would see the disintegration of society: Informers would be everywhere, looking to improve their standing with the local Communist commissar by bringing fresh gossip on counter-revolutionaries. After nationalization and the monetary reform, collaboration with the regime was the only way up. Some of your friends would say the wrong thing at the wrong time and would disappear down the uranium mines.

In the second half of the 1960s, people would timidly look to the future again. Things seemed to be changing. The Prague Spring of 1968 arrived and the reformers dropped restrictions on media, speech and travel. People were able to breathe freely again. Alas, these hopes would be crushed under the belts of Soviet tanks. Once again, the country was occupied. The effect on people’s morale was devastating. A 20-year-old student commited a protest suicide by setting himself on fire.

The era of “normalization” would follow — a return to the Soviet-style everyday grind. People would be living in fear again. Those who could, escaped the country, those who couldn’t found themselves in an “internal exile” — a willful disregard of the political situation and dedication of their time to a neutral activity, such as gardening or repairing a cottage in the mountains. The dissidents would try to reinvigorate the spirit of 1968 through a pamphlet called Charter 77, but the regime was too strong and the people too afraid — the only effect would be a loss of jobs and liberty for the authors of the Charter.

You would become a bitter cynic in the 1980s, after a life full of crushed hopes and friends lost to meaningless cruelty. On your deathbed, you wouldn’t have much hope for mankind.

Unpopular Opinion: Things Are Great And Getting Better

The 20th century was a very depressing time for those born in the wrong part of the world. You could have lived your whole life under a statist boot — first under the Nazis then under the Communists. A wretched existence.

After the downfall of the Soviet Union and the Iron Curtain along with it, the world became a more optimistic place — and not just for the 400 million people freed from the inhumane regime. Advocates for liberty all over the world finally had empirical evidence of historic proportions that central planning simply doesn’t work.

There are many more reasons to be optimistic about mankind’s future prospects. The downfall of the Eastern bloc, however impactful, wasn’t the greatest step forward in recent history by far. Practically everything in this world has been getting better for a long time now. Below are just a few of the most striking examples of mankind’s advancement, taken from the magnificent, fact-filled book called “Progress: Ten Reasons to Look Forward to the Future” by Swedish economist Johan Norberg.

- Hunger. “[Throughout history] famine was a universal, regular phenomenon, recurring so insistently in Europe that it ‘became incorporated into man’s biological regime and built into his daily life,’ according to the French historian Fernand Braudel. France, one of the wealthiest countries in the world, suffered twenty-six national famines in the eleventh century, two in the twelfth, four in the fourteenth, seven in the fifteenth, thirteen in the sixteenth, eleven in the seventeenth and sixteen in the eighteenth. In each century, there were also hundreds of local famines.” Famines are mostly a thing of the past now, and the remaining famines in the past decades were man-made by communism, war and embargoes.

- Clean water and sanitation. “During the late nineteenth and early twentieth century, many cities built modern water and sewer systems and began systematic garbage collection. Rising wealth made such costly ventures possible. The major change, though, came with the effective filtering and chlorination of water supplies in the first half of the twentieth century, after the germ theory of disease had been accepted. Life expectancy increased more rapidly in the USA during this period than in any other period in American history, and the introduction of filters and chlorination shows that clean water played a decisive role.” Today, 74% of the world population has access to clean drinking water, per Our World in Data.

- Life expectancy. “Average life expectancy in the world was thirty-one years in 1900. Today, amazingly, it is seventy-one years. … Since the late nineteenth century, infant mortality had been reduced from around ten to twenty-five dead per hundred births, to two to five per hundred births.”

- Poverty. “In the early nineteenth century, poverty rates even in the richest countries were higher than in the poor countries today. In the United States, Britain and France, around forty to fifty percent of the population lived in what we now call extreme poverty, a rate that you have to go to sub-Saharan Africa to find today. In Scandinavia, Austria-Hungary, Germany and Spain around sixty to seventy percent were extremely poor.” Today, the remaining pockets of extreme poverty are found mostly in authoritarian regimes and war-torn countries. Extreme poverty is no longer mankind’s default state, it is an exception.

Money: The Last Great Problem

Considering all of the above, this really is the greatest time to be alive for most of humanity.

But one of the remaining biggest issues has been left untackled so far. It is so pervasive that we could even call it the meta problem, a problem that underlies all the other problems.

Fiat money.

The monetary system that most of the planet has been subjected to for the past 50 years is a central planner’s dream. Without any link to gold whatsoever, the U.S. dollar and all the other currencies that have been tied to the dollar since the Bretton Woods system was established are subject to total state control.

If you think that labeling fiat money as a centrally planned system is far-fetched, consider these defining features:

- The government decides what constitutes money, via legal tender laws.

- The government issues bonds/treasuries, which act as the backbone of the monetary system.

- A state agency called the central bank creates money and/or sets the rules for money creation.

- Central banks grant special privileges in the form of licenses to commercial banks that can then partake in the money creation process.

- The central bank manages the interest rates.

- If problems emerge, the central bank changes the rules of the game and introduces new policies, such as quantitative easing, to prevent the system from collapsing.

For some strange reason, modern financial systems are often understood as a product of the free market. But if any other industry was managed this way, we would have no problem identifying it as a prime example of central planning.

What are the consequences of fiat money? Since money constitutes 50% of every single transaction, its quality affects the economy in all aspects:

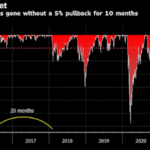

- Fiat monetary policy is the culprit in business cycles, speculative bubbles and capital misallocation; this is due to the fact that interest rates are set by the central planning committee — the central bank’s board of governors — instead of reflecting the market forces.

- Money creation is the source of the Cantillon effect: Those who are closest to the money spigots get richer (government, financial industry, wealthy investors, creditors), while those farthest from it get poorer (wage earners, savers).

- The constant push to lower the interest below the natural market rate drives an increasing indebtedness of all economic sectors (government, companies, households): At the beginning of 2021, global debt was $281 trillion or 355% of world GDP — a steep rise from $67 trillion, or 198% of world GDP in the year 2000.

The combined overall effect is that mankind is wasting a tremendous amount of resources. Millions of people are thus unnecessarily kept in poverty or prevented from fulfilling their full potential.

The evil of fiat money is especially devious because of how unseen it is. It seems to work fine on the surface as the negative effects are all indirect and to understand their cause, one needs to carefully study economics and history. This, in turn, leads many to blame the devastating effects of fiat money on the free market, with an inevitable conclusion that it is more central planning that we need, not less.

Fix the money, fix the world is a very fitting slogan that captures the essence of the problem.

Before bitcoin, there wasn’t much hope for fixing money. Those who understood the problem of fiat money couldn’t offer a satisfying alternative. Some believed that we should return to the gold standard — but this begged the nagging question of its practicality. A return to the gold standard would have to be orchestrated by the government; the very same institution that greatly profits from the existence of fiat money. The pre-bitcoin era was thus very depressing for the free-market monetary economists.

Bitcoin is a much more pragmatic alternative to fiat money than gold could ever be. Gold requires trusted third parties such as banks and trusted monetary instruments such as checking accounts and banknotes, if it were to function as money in the modern economy. Bitcoin, on the other hand, comes with worldwide transaction capabilities that rely on cryptographic assurances rather than trust.

Don’t underestimate how early we still are in the race between bitcoin and all the world’s fiat currencies. Most people are still skeptical or completely ignorant about the prospects of bitcoin fixing the problem of fiat money. Starting to save in bitcoin now and protecting your legacy via hardware wallet use is one of the most impactful decisions you can make in your life.

You are not too late for bitcoin.

Be Optimistic

Many people have a pessimistic outlook, considering the events of the past 18 months. But when in doubt, zoom out. We are living in a very optimistic era. The idea of central planning in the field of production and distribution of goods has been discredited long ago. Most of the greatest problems of history are all but solved. And we have the solution at hand for the persistent meta problem of fiat money.

Compared to the hopeless situation of someone born 100 years ago, we have it so much better now. The sad fellow from the beginning of the article had very limited information about what is going on in the world and almost no hope of escaping the consequences of the centrally planned economy. His one chance at a better life was to physically escape — an option with high personal risks and very uncertain outcomes.

Today, we have an option to opt out of monetary central planning no matter where we live. We can literally take money into our own hands, while relying on no one and preserving our privacy.

And that is a reason to be optimistic.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.