Though Bitcoiners often fight solar power as merely another ESG attack vector, it could make Bitcoin more resilient and decentralized.

This is an opinion editorial by Robert Hall, a content creator and small business owner.

I don’t know where you come down on the solar energy debate, but whether you are for or against investing in more solar power is irrelevant. Regardless of how you feel about green energy, installing rooftop solar panels has become a prevalent choice for homes, schools and business owners over the last 10 to 15 years, and installations don’t seem to be slowing down any time soon.

Did you know nearly 4% of U.S. homes have installed solar panels? This isn’t a small number and it will continue to increase, especially with the Inflation Reduction Act providing subsidies for solar energy.

A study by Princeton University found that added solar capacity could increase from 10 gigawatts (GW) in 2020 to five times as much by 2024 and 100 GW per year by 2030.

As you can see, solar energy isn’t going anywhere anytime soon. So, instead of being hostile to solar energy, should Bitcoiners think about changing their position on solar? I think it might be time to reconsider.

Hostility Toward Solar

In Bitcoin circles, solar is often synonymous with ESG, a set of guidelines used by socially-conscious investors to determine how companies impact the environment and communities where they operate. Sounds harmless right?

But if you are in the know, you understand that behind the nice-sounding platitudes, there is an agenda being enacted by the elites in society to control how much energy others can use, how much meat they can eat, how many miles they can travel and so on. It’s a very twisted way of looking at the world.

This worldview is unsurprising because these elites are used to getting their way and using the Cantillon effect to their advantage. For that reason, many Bitcoiners associate solar power and ESG considerations with the fundamental problems of the legacy economy.

But the real question we face as Bitcoiners and as free people of the world is: What can we do to secure our freedom in an environment of increased surveillance and raging inflation that is stealing our wealth and our time?

The answer is that we need to acquire our own energy production.

Personal Energy Sovereignty

The one thing that Bitcoin has taught me is that decentralization is critically vital to the resilience of any system, especially energy and Bitcoin. Centralization of power makes a population easier to control and manipulate.

Take a look at what Ukraine is going through as concerted attacks by Russia attempt to knock out its energy grid. This is only possible because its energy grid is centralized, just like every other countries in the western world. Centralization of energy production may make energy cheaper to produce, but it is still a central point of failure that any adversary could exploit to their advantage.

Decentralizing energy production is the only way to make a nation resilient to attack and keep the lights on in an emergency. And rooftop solar is the only technology that could do this at scale and relatively quickly.

Rooftop solar unshackles the individual from the central power grid, promotes self sovereignty and turns an energy buyer into an energy seller. Being self sovereign is where rooftop solar and the values of Bitcoin align perfectly.

Solar Plus Bitcoin Mining Equals Freedom

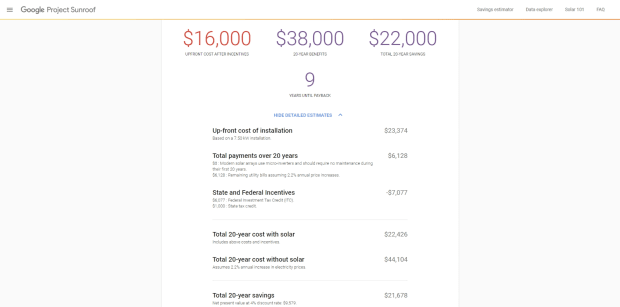

According to the U.S. Energy Information Administration, the average home in America uses about 886 kilowatt hours (kWh) of energy per month. Solar installation costs vary by location, but on average, you can expect to pay around $18,000 to $25,000. Using a website such as Project Sunroof, you can enter your address and see how much a solar array would cost for your home. Here is what I got back when I entered my address:

As you can see, the potential savings are pretty significant. The money saved with rooftop solar can buy more bitcoin, instead of paying a utility company. More bitcoin, you say? Yes, please!

And the savings aren’t even the best part, my friends. When you add a Bitcoin miner to the mix, now you are really cooking with gas! Rooftop solar is notorious for being unpredictable and oversupplying the grid with power during the day when demand is lower. Utility companies often will pay you for this oversupply of energy, but don’t pay you very much.

For example, in Arizona, utility companies will pay you up to 9.4 cents per kWh of excess power. The kicker is that this rate has the potential to go down 10% every year. This, no doubt, is meant to stop people from putting solar panels on their roofs, thus limiting self sovereignty and independence from the grid.

So, instead of selling your excess power to the utility company, you can use the excess energy to mine Bitcoin! Which one sounds like a better deal? Stacking sats with the sun or getting paid back with a dirty, depreciating, fiat currency?

Not only are you monetizing the excess energy that your home produces with solar panels, but home mining with them also decentralizes Bitcoin mining even further, thus making the network more robust and resilient over the long term.

Now, envision this at scale: Millions of homes with solar power and Bitcoin miners hashing away. This is the kind of future I want to live in. I could honestly see solar companies in the future offering Bitcoin mining as a value-add product. It’s a no brainer if you ask me.

Rooftop solar aligns with the ethos of Bitcoin and should be embraced by Bitcoiners.

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.