Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

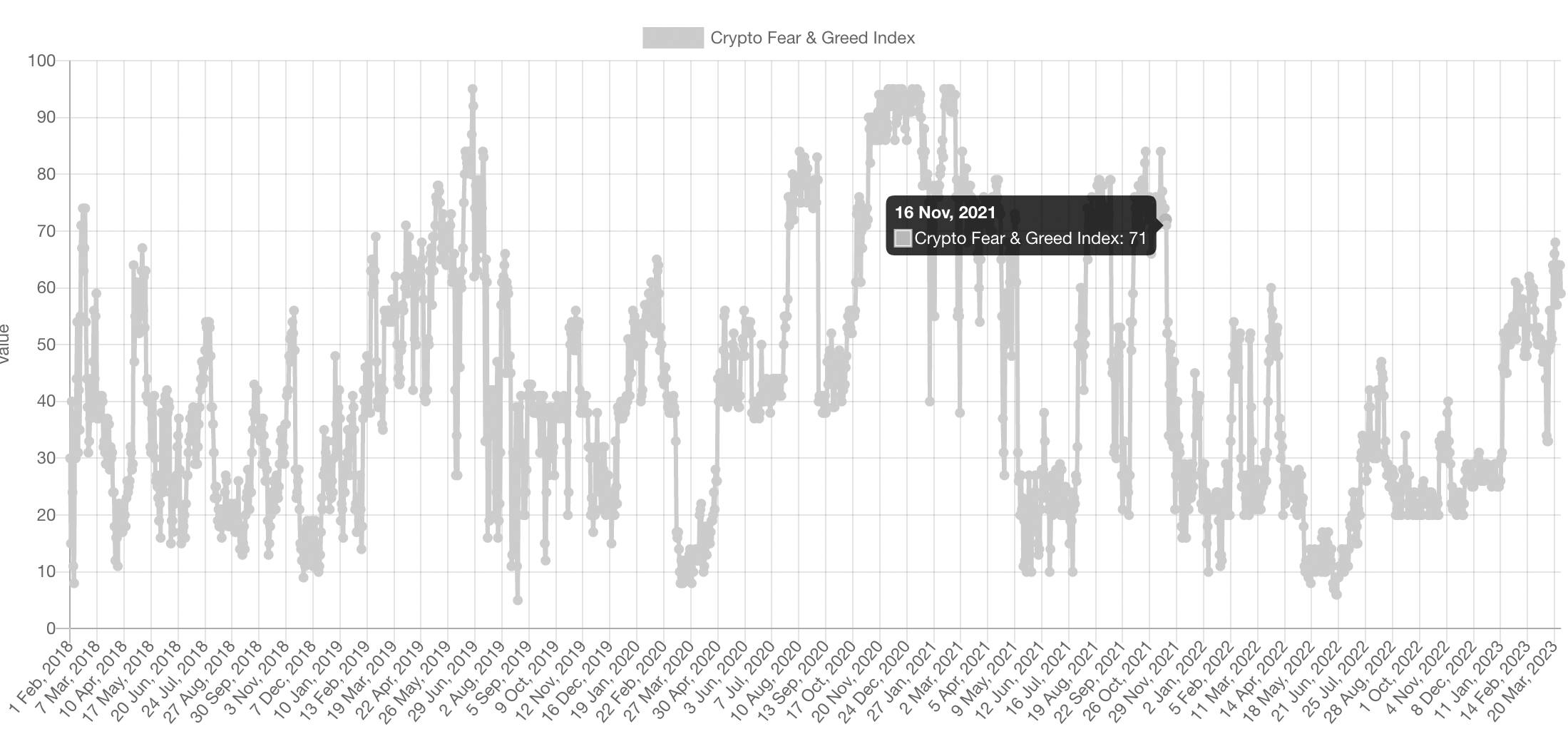

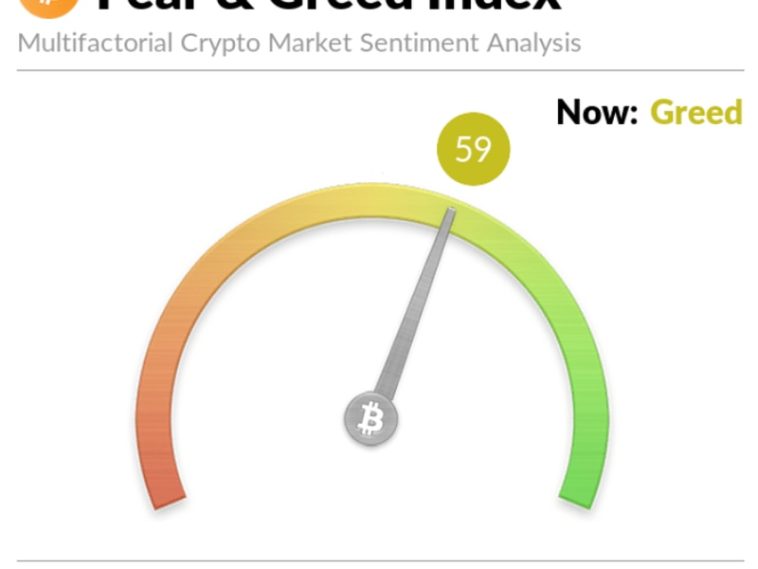

The crypto Fear and Greed index, a metric that aims to measure current sentiment in the market, dipped to 59 on Tuesday, sliding from a nearly 18-month high of 68 reached one week ago, according to data from alternative.me.

Readings above 50 indicate market sentiment has moved into the “greed” stage, while those below 50 indicate “fear.” The index hadn’t been as high as 68 since November 2021 when bitcoin (BTC) reached an all-time record above $69,000.

Although the gauge has declined since last week to 59, it remains in the “greed” zone, suggesting investor sentiment for now remains bullish.

(Alternative.me)

Throughout most of 2022, the index was stuck in the “fear” and “extreme fear” territories for good reason. Crypto prices collapsed during a wave of bad news and bankruptcies in the industry.

The rebound to “greed” in 2023 came as crypto prices bounced despite a growing number of regulatory crackdowns and macroeconomic fears. Bitcoin was recently just shy of $27,000 after starting the year around $16,500.

“Bitcoin is displaying such unbelievable resilience to what is happening around it, even in the crypto industry,” wrote Craig Erlam, senior analyst at Oanda, in a market note. He added that it’s important to wonder how sustainable this can be in the longer term.

The U.S. Commodity Futures Trading Commission (CFTC) is suing crypto exchange Binance and founder Changpeng Zhao on allegations the company knowingly offered unregistered crypto derivatives products in the U.S. against federal law. Bitcoin dropped about 3% following the news.

“While bitcoin did fall a few percent in response to reports that the CFTC is suing Binance, the drop doesn’t feel particularly significant,” said Erlam, “especially in light of the gains we’ve seen in recent weeks and this year as a whole.

“Of course, that isn’t to say it’s suddenly going to plunge but it will no doubt be interesting to see how it performs over the coming weeks, especially if further turbulence is coming for the industry.”

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/03/28/fear-and-greed-index-pulls-back-after-hitting-greediest-level-since-late-2021/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)