Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

The bewilderingly fast rise of pepecoin (PEPE), a meme coin introduced mere weeks ago that’s now worth more than $1 billion, is making gigantic fortunes for those undeterred by warnings this is a fad that will end badly.

A perfect example: a pseudonymous trader named dimethyltryptamine.eth spent $263 just three weeks ago to buy trillions of PEPE tokens. That former pittance has turned into $3.8 million in profits from tokens they’ve already sold, and their remaining holdings are worth about $9 million, according to data by blockchain research firm Arkham Intelligence. That’s an almost 5,000,000% profit.

The trader is benefitting from the breakneck rally of a coin based on the “pepe the frog” meme, a popular symbol in crypto circles. Launched in April, the meme coin’s market capitalization astonishingly surpassed $1 billion on Friday and, according to CoinGecko, at one point was worth more than Arbitrum’s ARB, which is also among the hottest newly issued tokens of 2023.

Analysts, however, have raised concerns about the concentrated ownership of pepecoin, pointing to a handful of traders acquiring substantial amounts of PEPE when the token was released last month. Blockchain sleuth Lookonchain unveiled five accounts connected to a wallet belonging to pepecexwallet.eth, which received funds directly from the token’s deployer contract, acquired over 8.87 trillion PEPE after issuance for just $385.

Dimethyltryptamine.eth, which wasn’t cited among the insider wallets by Lookonchain but belongs among the earliest buyers, purchased 5.907 trillion of PEPE tokens for $263 in two transactions on April 14 using UniSwap, Arkham shows. The trader also paid $17 for gas fees.

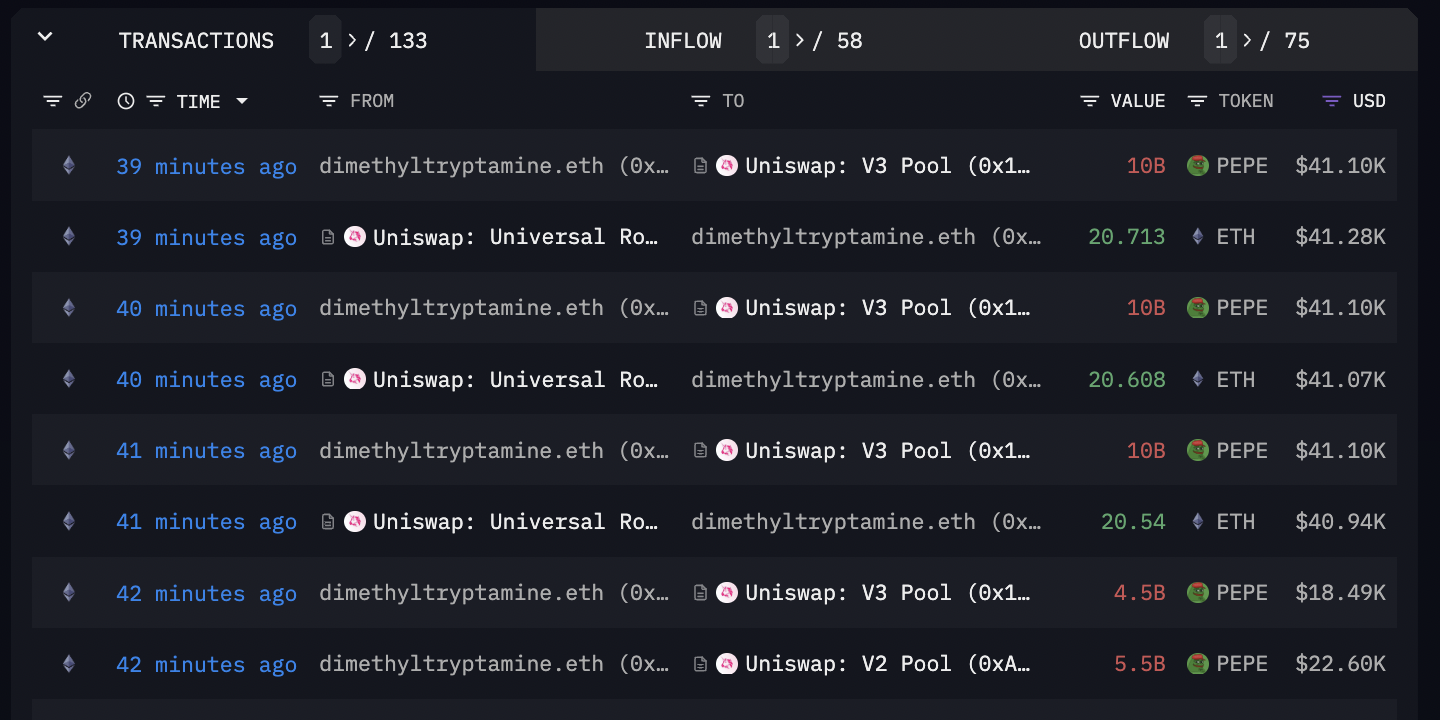

Since then, the trader has been gradually taking profits by sending smaller amounts multiple times a day to UniSwap, and receiving ether (ETH) in exchange. The wallet has sent $3.8 million of PEPE to UniSwap in the past month, per Arkham data, presumably to take profits, with $2.4 million of that transferred in the past 24 hours.

Pepecoin trader has been taking profits. (Arkham Intelligence)

Edited by Nick Baker.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/05/05/pepecoins-bewildering-rise-turned-a-pittance-into-an-almost-5000000-meme-coin-profit/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)