This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

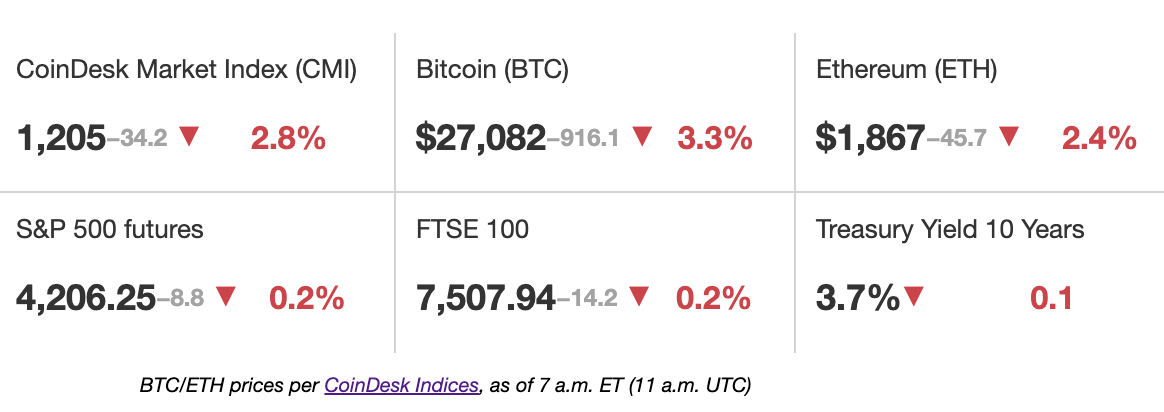

Latest Prices

Top Stories

Bitcoin (BTC) ran into selling pressure early Wednesday after a top U.S. Federal Reserve official said there is no compelling case to halt the central bank’s rate hike cycle. The Fed’s historic string of monetary tightening has been among the major reasons for continued bear market in cryptocurrencies. “I don’t really see a compelling reason to pause,” Federal Reserve Bank of Cleveland President Loretta Mester told FT in an interview published on Wednesday. “I would see more of a compelling case for bringing the rates up and then holding for a while until you get less uncertain about where the economy is going,” Mester added. Her remarks helped send the U.S. dollar higher and bitcoin lower, with the crypto now off 3% over the last 24-hours to $27,000. Ether is also lower by 2% over that period.

U.S. Commodity Futures Trading Commission (CFTC) staff are warning companies to be wary of and to actively counter risks from clearing digital asset transactions. The CFTC’s Division of Clearing and Risk sent out the advisory on Tuesday, saying it would put a special focus on the emerging risks in crypto in response to an upswing in its supervised entities clearing such trades. These risks include potential conflicts of interest, protections against cyber threats and how firms are managing physical delivery of digital assets in transactions requiring delivery. The agency said it expects companies “to actively identify new, evolving, or unique risks and implement risk mitigation measures tailored to the risks.”

The U.S. Securities and Exchange Commission (SEC) settled charges with a former Coinbase (COIN) product manager and his brother tied to 2022 allegations of insider trading on certain cryptocurrencies listed by the exchange, the regulator announced Tuesday. Ishan Wahi and his brother Nikhil Wahi were arrested last year on charges of wire fraud conspiracy and wire fraud in connection with a scheme to commit insider trading. On the same day, the SEC brought insider trading charges against the duo. In Tuesday’s announcement, the SEC said the brothers agreed to disgorge their gains. Both brothers previously pleaded guilty to the Department of Justice criminal charges, with Ishan Wahi now facing a 2-year sentence and Nikhil Wahi serving a 10-month sentence. The SEC said that the brothers’ fines from their criminal case satisfy the civil case’s settlements, and it would not seek any other penalties.

Chart of the Day

-

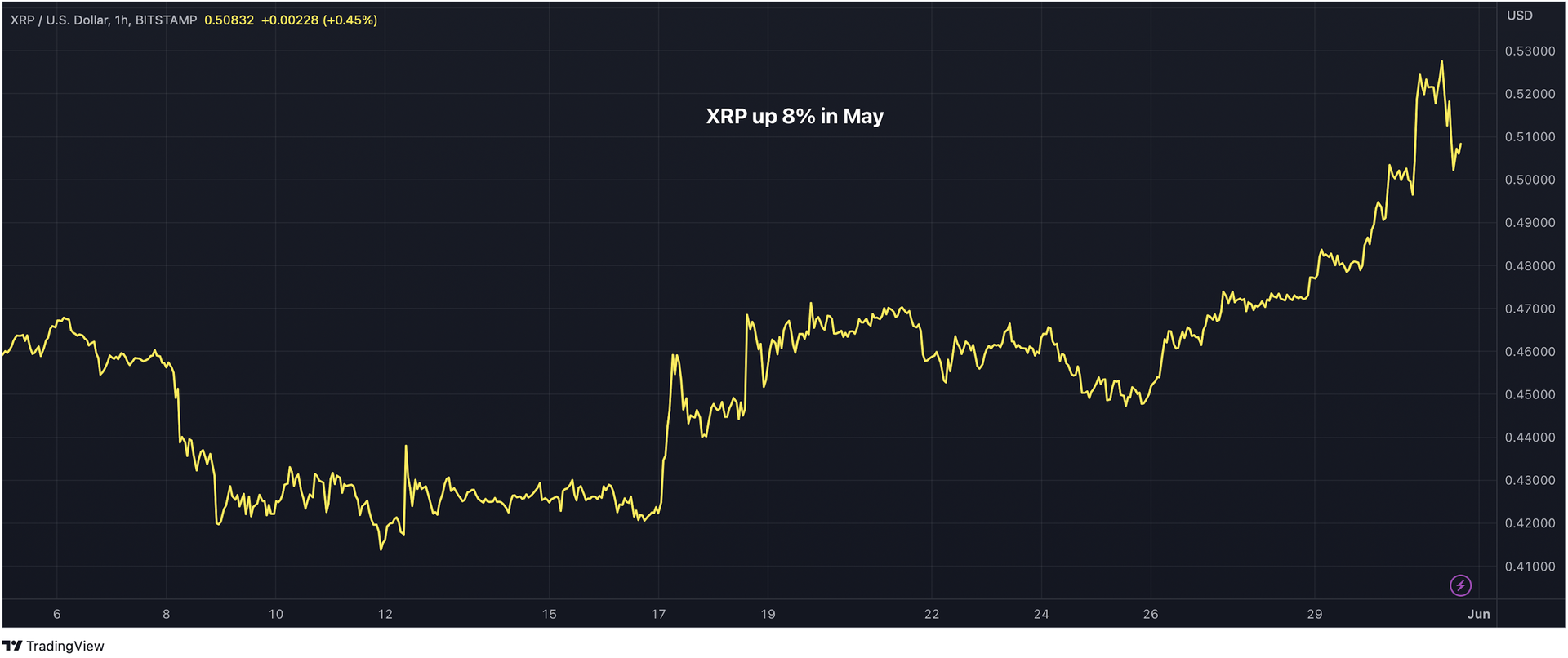

XRP has risen by more than 8% to $0.51 this month, beating market leaders bitcoin and ether.

-

“There has been speculation that the SEC / Ripple legal case could be settled within the next few weeks, which has driven XRP prices higher,” crypto services provider Matrixport said.

-

“A break above resistance at $0.55 could see prices rally to the next key resistance level of $0.80 — which is +44% higher,” Matrixport added.

Trending Posts

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

https://www.coindesk.com/markets/2023/05/31/first-mover-americas-bitcoin-slumps-back-to-27k-on-fed-worry/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)