This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

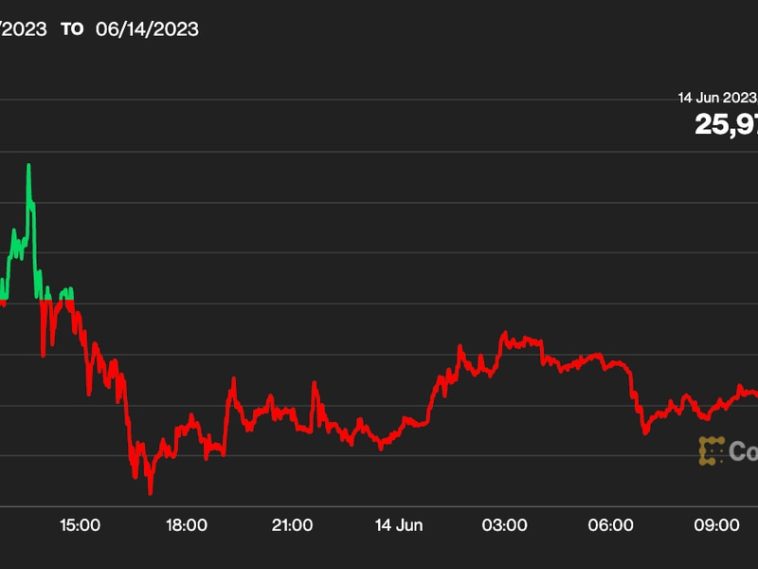

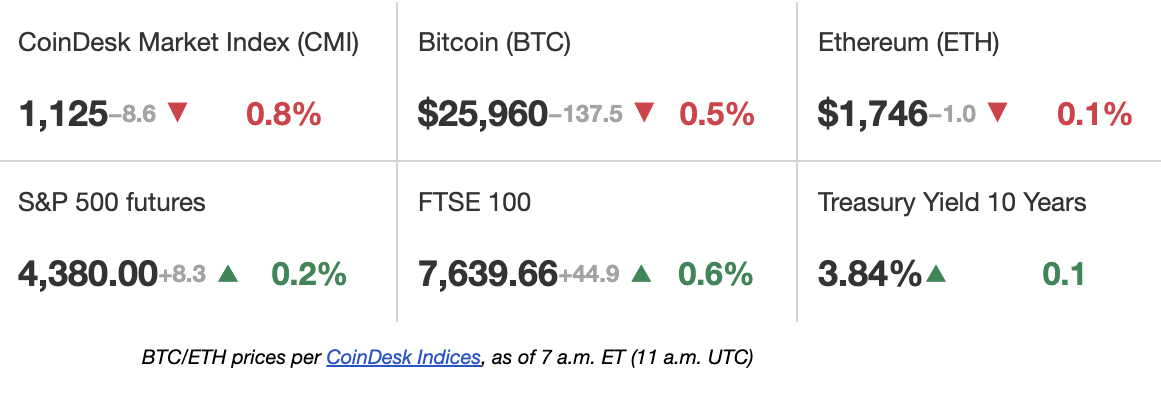

Bitcoin (BTC) traders are taking a defensive stance ahead of Wednesday’s meeting of U.S. Federal Reserve’s Federal Open Market Commitee (FOMC) meeting, with most expecting a “hawkish” pause, i.e., the central bank leaving interest rates unchanged while keeping the door open for future increases. The Fed is set to announce its interest rate decision on Wednesday at 2 p.m. ET (18:00 UTC). Puts – or bearish bets – tied to bitcoin are trading pricier than bullish calls heading into the Fed meeting, according to options risk reversals data tracked by Singapore-based crypto trading giant QCP Capital. Traders often consider put bias as showing a nervous mood in the market. Bitcoin is little-changed over the past 24 hours at around $25,900. Top performers amongst digital assets on Wednesday were Binance’s BNB token, which gained 5%, and Chainlink (LINK) which was up almost 3% on the day.

The federal judge overseeing the U.S. Securities and Exchange Commission’s (SEC) case against Binance and Binance.US declined to approve a temporary restraining order freezing the U.S. trading platform’s assets. The decision allows Binance.US to continue doing business while hashing out restrictions with the regulator. If the two sides can agree on limits, Judge Amy Berman Jackson of the D.C. District Court said “there’s absolutely no need” for a restraining order. In the meantime, the judge ordered Binance.US to provide a list of its business expenses to the court, and ordered the parties to continue negotiating. A status update is due by close of business Thursday.

Bitcoin supply on crypto exchanges has slipped to its lowest levels since February 2018, data from on-chain analytics firm Santiment shows. The decline has been particularly considerable since the SEC’s lawsuits against Coinbase and Binance earlier this month, with 6.4% of supply leaving exchanges in the past week. Supply has been steadily falling since 2020, when it peaked in the depths of the then-bear market, the data shows. This action suggests traders and investors have been continually taking their bitcoin off exchanges in favor of self-custody, said Santiment.

-

Charts show the spread between the Federal Reserve’s benchmark fed funds rate and inflation metrics – the headline Consumer Price Index (CPI) and the core CPI. (edited)

-

The spreads have recently turned positive.

-

In other words, the fed funds rate adjusted for inflation has turned positive, denting the appeal of zero-yielding assets like gold and bitcoin, according to Singapore-based QCP Capital.

Trending Posts

Edited by Stephen Alpher.

https://www.coindesk.com/markets/2023/06/14/first-mover-americas-bitcoin-traders-await-fed-decision/?utm_medium=referral&utm_source=rss&utm_campaign=headlines