This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

The benefits of tokenization are simple, the process brings operational efficiencies and improved liquidity and accessibility, Bernstein said in a research report on Tuesday. Tokenization is the process by which real-world assets are converted into blockchain-based tokens. Bernstein estimates that the size of the tokenization opportunity could be as much as $5 trillion over the next five years, led by stablecoins and central bank digital currencies (CBDC), private market funds, securities and real estate. Currency tokenization, via stablecoins and central bank digital currencies, will see application in on-chain deposits and payments, the report said, with about 2% of global money supply to be tokenized over the next five years, which is about $3 trillion, the report added.

Japan’s cryptocurrency exchanges are urging regulators to relax margin trading restrictions on popular cryptocurrencies such as bitcoin (BTC). Exchanges in the country once offered leverage of up to 25 times principal capital, and trading volumes reached as high as $500 billion annually in 2020 and 2021, according to Bloomberg. In early 2022, however, Japanese regulators limited crypto exchanges to offering leverage of only twice the principal, which led to trading volumes dropping drastically last year. The Japan Virtual and Crypto Assets Exchange Association, a self-regulated body of local exchanges, is now arguing that these restrictions hinder market growth and discourage new participants.

Bitcoin (BTC) traded little changed on Tuesday as China’s first cut in benchmark lending rates in 10 months failed to lift the mood in traditional markets. The People’s Bank of China lowered the one-year and five-year loan prime rates by 10 basis points to 3.55% and 4.3%, respectively. The one-year rate is a medium-term lending facility for corporate and household loans and the five-year figure is the reference rate for mortgages. Last week, the country’s biggest state banks cut rates on demand deposits by 5 bps and 15 bps on three- and 5-year time deposits. A basis point is a hundredth of a percentage point. The looser conditions contrast with continued monetary tightening in western economies and follow recent economic reports that indicate the world’s second-largest economy is losing steam and is on the brink of deflation.

Chart of the Day

-

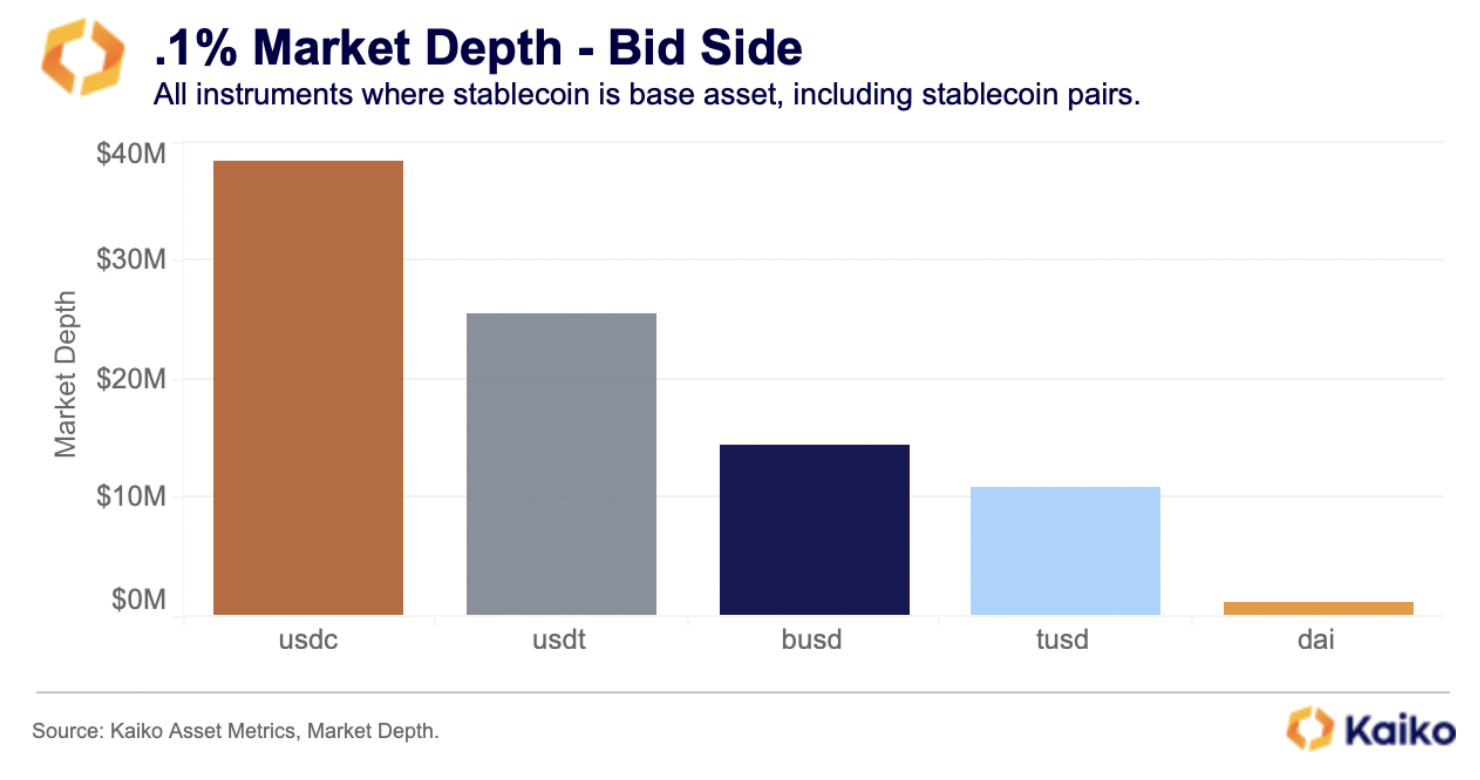

The chart shows a 1% bid depth in top stablecoins or dollar-pegged cryptocurrencies. The 1% bid depth is the collection of buy orders within 1% of the mid-price or the average of the bid and the ask prices and is widely tracked to gauge liquidity in markets.

-

Circle’s USDC has flipped tether (USDT) as the most liquid stablecoin.

-

“Today, USDC has the highest market depth for its ‘price discovery’ markets, as we will call them, which include both fiat and stablecoin pairs like USDC-USDT, USDC-EUR, and USDC-USD,” analysts at Paris-based Kaiko said in the weekly research note.

-

“Another way to think about the data would be: to push down the price of USDC by 1%, you would need to sell $38mn,” analysts added.

Trending Posts

Edited by Sheldon Reback.

https://www.coindesk.com/markets/2023/06/20/first-mover-americas-tokenization-might-be-a-5t-opportunity/?utm_medium=referral&utm_source=rss&utm_campaign=headlines